October to January, year after year, signifies a special time in the retail calendar. Love it or loathe it, peak season is the highlight of the year. And this peak season is proving more unique than we ever could have anticipated. With Covid-19 accelerating the shift to online, Black Friday is predicted to see online sales surge by 35-45%. For many its the peak day, with 35% of retailers agreeing Black Friday is their busiest day. It’s not surprising given 50% of consumers we surveyed said they plan to spend more online this year.

So what does this mean for brands and retailers? How are they seeing the holiday period evolving and what trends are front of mind? We worked with Retail Gazette to survey 134 brands and retailers in the UK to understand their priorities for peak and beyond. And the results are in.

The Most Wonderful Time of the Year

44% of retail businesses said a quarter of their yearly sales are taken over the peak period and 40% said it’s more than half. Furthermore, it’s anticipated that this year consumers will be heading online to hunt for presents and decorations, 15% of retailers expect a quarter of their peak season sales to be online, 19% expect the figure to be close to half and another 19% expect three quarters to be online.

Getting in the Christmas Spirit Early

Whether it’s uncertainty around Christmas plans, the recent Amazon Prime Day, or just the desire to spread positive cheer — the festive season has begun earlier than ever before.

We asked both retailers and consumers about their shopping plans and it’s clear to see sales are spiking early this year.

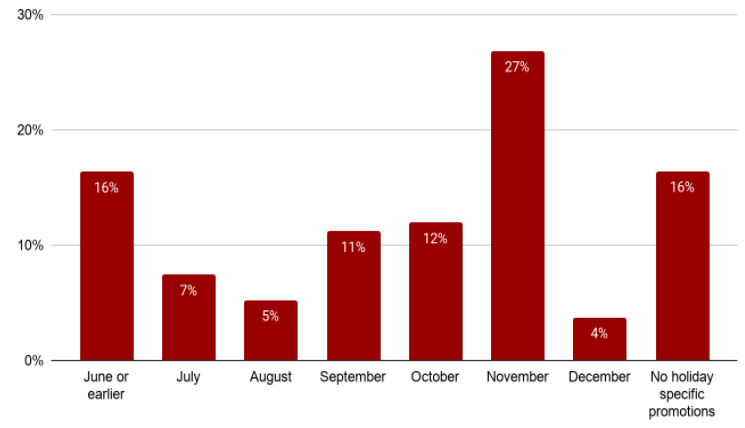

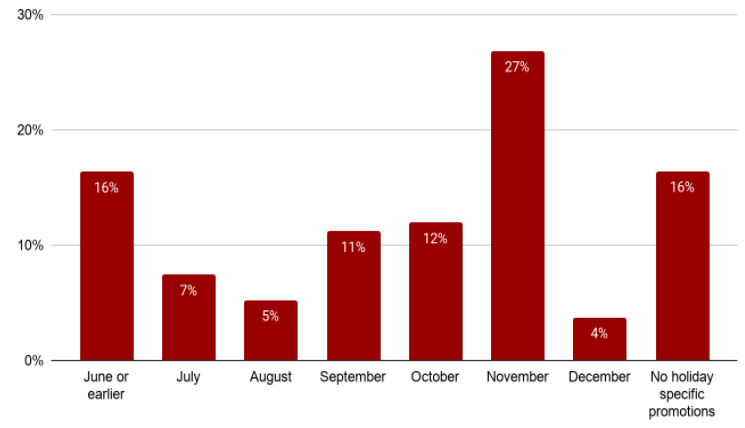

51% of retailers told us they plan to start promotions before November and only 16% not planning any holiday discounts at all. This is a smart strategy as we know there’s a worry about carrier capacity this year and the more retailers can smooth those peaks, the more likely they will be to deliver on time.

And it’s a good thing too. Back in August we asked consumers how they plan to shop over the festive season and it was clear to see they planned to be prepared, 14% had already begun.

Making a List, Checking it Twice

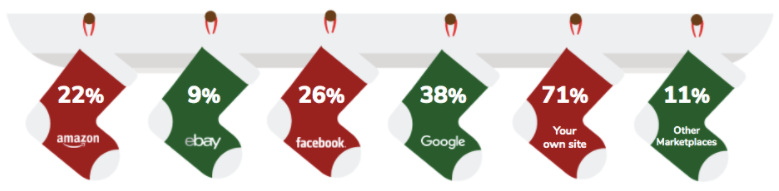

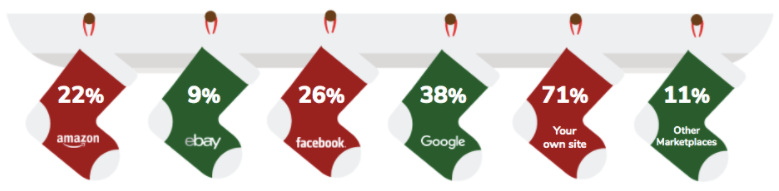

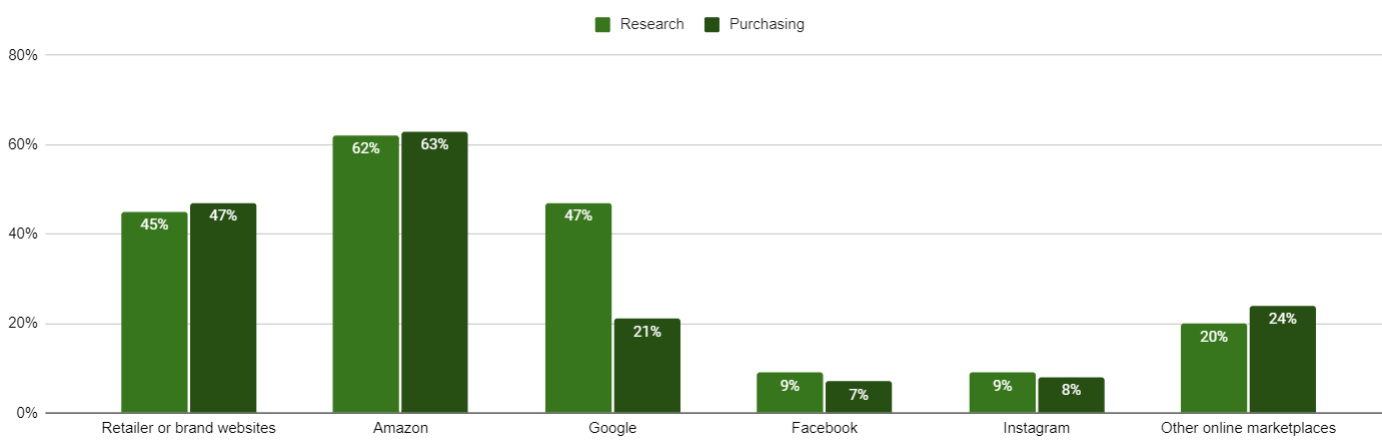

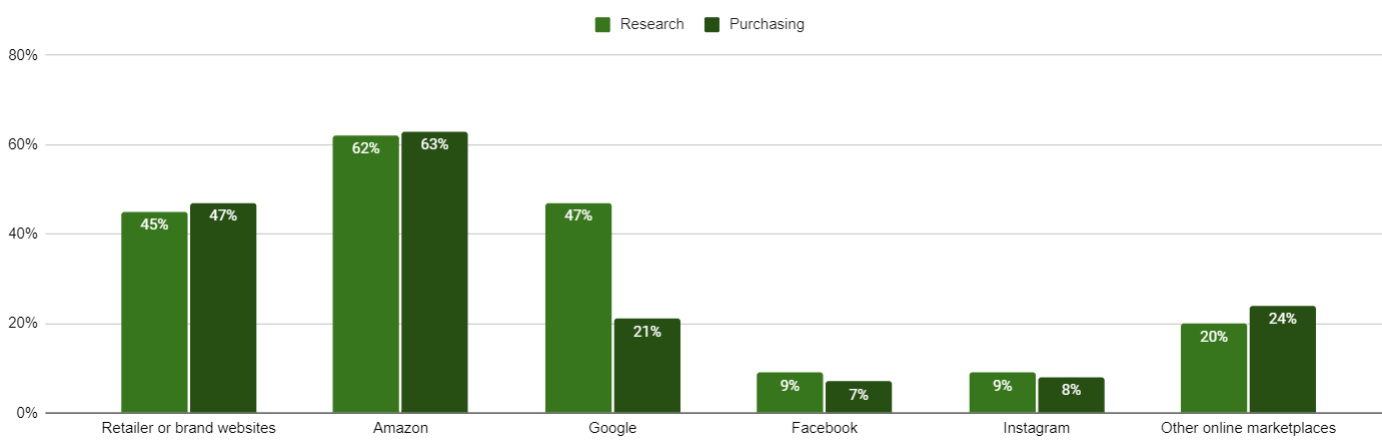

Consumers are spending more time on devices than ever before. And it’s not surprising they rely on multiple channels to conduct their product research. We asked retailers where they think their customers will be headed this season to research products and gift ideas:

But when we asked consumers about their researching and purchasing habits, it was a different picture. For 62% of respondents, their go-to channel was Amazon with a further 20% heading to other marketplaces.

In fact, an astonishing 70% of consumers told us they planned to check prices on Amazon first before purchasing anywhere else and it seems that only 28% of the companies we surveyed sell on Amazon at all.

Marketplaces have seen a massive growth since March, attracted to their extensive product selection, competitive pricing and fast delivery — consumers are heading there in their droves.

EBay announced their annual active buyers grew by 5% to 183 million global active buyers and the eBay Q3 2020 earnings reported GMV of $25.0 billion, up 22% year on year. Or take OnBuy, the British based marketplace who recorded 1.5 million users between 01-08 November, with users up by 600 per cent on the same period last year and sales up 837 per cent.

Our research shows that 58% of consumers have discovered products by browsing marketplaces (Amazon, eBay, etc.) yet 33% of retailers we surveyed said they don’t sell on any at all. Though it was reassuring to hear that 31% plan to expand to more marketplaces in 2021.

And it’s not just marketplaces seeing a surge. The rise of social commerce is one of the defining retail trends of the past five years. Since the pandemic began, consumers are researching more and more on social channels. We asked the same question back in January and whilst channels like Amazon remain consistent, the biggest growth we saw was social media platforms like Facebook and Instagram. In January 19% of consumers said they research products on Facebook, by late August this figure had jumped to 31%. And it’s a similar story for Instagram, 16% were using the platform for research in January and this rose to 25% in late August. Needless to say that these two social platforms are most popular with the 18-25 year old demographic, 49% say they use Facebook for product research and 56% said they use Instagram.

Setting New Year’s Resolutions

It’s been a challenging year for the retail industry. Covid-19 has accelerated a number of the trends and transformations we were seeing already, but at a pace, many retail businesses were not prepared for. To remain competitive in this brave new world of retailing, brands and retailers need to be prepared to:

Grow Omnichannel Strategy: Marketplaces are an important channel to reach more consumers and grow sales. Marketplaces and online can no longer be ignored from an omnichannel strategy. In fact, since the outbreak, 53% of Brits have discovered new brands and retailers that they will continue to shop online.

Build the Online Experience: Focus on improving online experiences to fine-tune conversion rates is not only extremely important, but it’s fundamental. If you sell online it is expected you have a responsive and fast website as well as a streamlined checkout process.

Diversify your Channel Mix: Social media has historically been seen as a discovery and brand awareness channel but more and more consumers are looking for in-app purchasing journeys and a seamless shopping experience. If you are selling to certain age groups that tend to use it more as a research tool, make sure to advertise on social media. Even if your age group is wider, consider segmenting your campaigns so that you can reach and stay top of mind for these high-intent audiences.

If you’d like to explore these areas in more detail, why not check out our on-demand webinar with Retail Gazette where we delve into these results further. Or head over to our resource bank where we have a host of materials to support your business transformation and optimisation.